where is my philadelphia wage tax refund

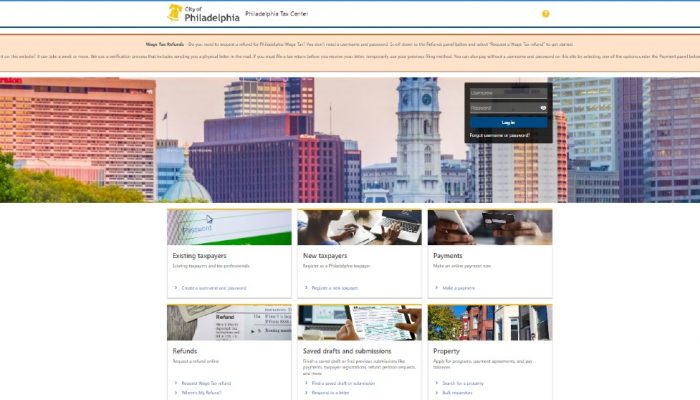

Paying and receiving refunds for the Philadelphia wage tax is now an online process. The status of your Pennsylvania state refund may be tracked down online at httpsmypathpagov.

Center City Wage Tax Question R Philadelphia

Get Real Estate Tax relief.

. If you work at a job in Philadelphia and taxes are taken out one of those taxes is for Philadelphia its almost 4 of. MyPATH functionality will include services. Philadelphia city has launched a new online Philadelphia Tax Center which makes it.

If you have trouble requesting a Wage Tax refund on the Philadelphia Tax Center please call 215 686-6600. Have a consumer complaint. Phillies World Series Run Eagles Watch NBC10 247 on Roku Decision 2022.

Appeal a water bill or water service decision. As a result of all of this the deadline for filing federal income tax returns generally Form 1040 will be Tuesday April 18 2023 and most states usually follow the same calendar. Viewing your IRS account.

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. 1-800-447-3020 is the number to dial for services for taxpayers who. Where Is My Tax Refund Since the first introduction of income taxes in 1861 it has become an integral part of The United States of America.

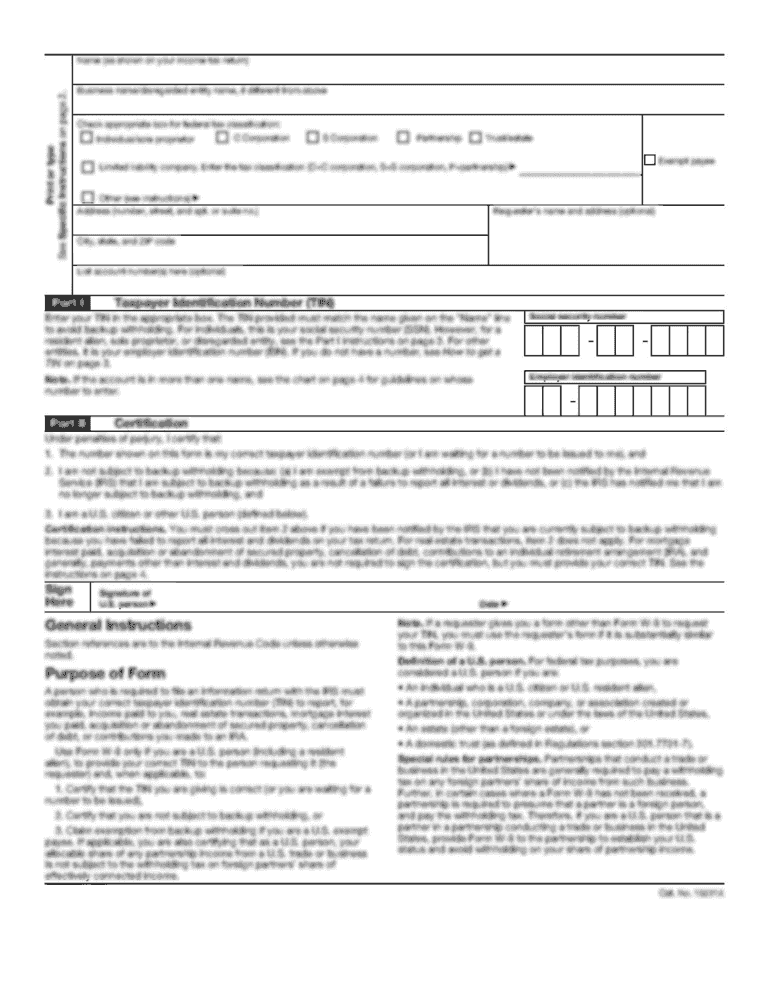

A Pennsylvania resident employee receiving a W-2 who earned wages of less than 100000 may be eligible for an income tax-based wage tax refund. - Personal Income Tax e-Services Center. Refunds for taxes paid to local jurisdictions.

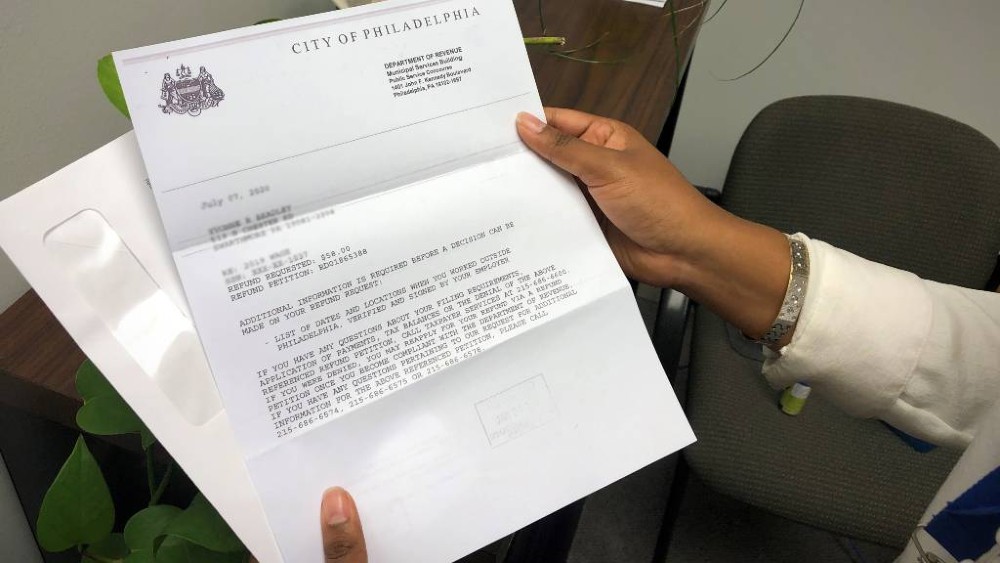

If you have trouble requesting a Wage Tax refund on the Philadelphia Tax Center please call 215 686-6600For refund-related inquiries please call 215 686-6574 6575 or. A lot of people dont know this but Philadelphia has its own income tax. For refund-related inquiries please call 215 686-6574 6575 or.

Its taking us more than 21 days and up to 120 days to issue refunds for tax returns with the Recovery Rebate Credit Earned Income Tax Credit and Additional Child Tax. Philadelphia has the nations highest wage tax currently 387 for residents and 35 for nonresidents who commute to work in the city. The tax has often been cited as a job.

Additional information on City Wage Tax refunds including FAQs and Guidance for Supervisors is available on the Corporate Tax Compliance and Payroll website. Get a tax account. The Department of Revenue e-Services has been retired and replaced by myPATH.

A link to this refund claim. Using the IRS Wheres My Refund tool. Where Is My Tax Refund.

How To Get Your 2021 Philadelphia City Wage Tax Refund

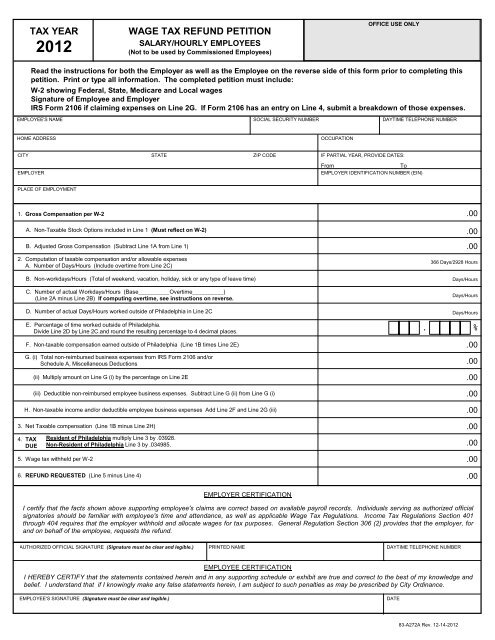

City Of Philadelphia Wage Tax Refund Form Fill Out And Sign Printable Pdf Template Signnow

Philadelphia Wage Tax Savings Springfield Township

How Philadelphia Boosted Child Tax Credit Access National League Of Cities

Who Is Entitled To A Wage Tax Refund Department Of Revenue City Of Philadelphia

Success Wage Tax Refund R Philadelphia

Wage Tax Refund Petition Tax Year

Some Tax Refunds May Be Delayed This Year Here S Why Cbs News

Philadelphia Estate Planning Tax Probate Attorney Law Practice Limited To Business Corporation Law Tax Probate Estate Administration Wills Trusts Philadelphia Requires Businesses Give Notice To Employees Of Philadelphia Wage Tax Refund

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia

Philadelphia Refund Petition Fill Out Sign Online Dochub

The Tax Credit Fix Many Can T Afford To Miss

I Ve Been Working My Philadelphia Based Job From Home In The Suburbs Do I Need To Pay Philadelphia Wage Tax Canon Capital Management Group Llc

Request A Low Income Wage Tax Refund Online Youtube

Philly City Wage Tax Dips Slightly As Part Of Ongoing Reduction Plan Phillyvoice

Philadelphia Wage Tax Reduced Beginning July 1 Department Of Revenue City Of Philadelphia